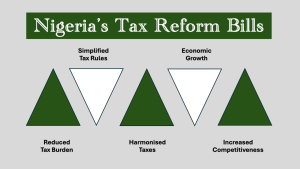

Households and individuals including the youth

- Complete exemption of low-income earners up to N1m p.a. (about N83k per month) from PAYE

- Reduced PAYE tax for those earning a monthly salary of N1.7m or less

- Zero (0%) VAT on food, healthcare, education, electricity generation and transmission

- VAT exemption on transportation, renewable energy, CNG, baby products, sanitary towels, rent and fuel products

- Tax break for wage award and transport subsidy to low-income earners

- Tax incentives for employers to hire more people incrementally than in the previous 3 years

- Exemption of stamp duties on rent below N10m

- PAYE tax exemption for other rank and armed forces fighting insecurity

- Friendly tax rules for remote workers and digital nomads

- Clarity on taxation of digital assets to avoid double taxation and allow deduction for losses

Small Businesses

-

- Increase in tax exemption threshold for small businesses from annual turnover of N25m to N50m

- Exemption from company income tax for small businesses (tax at 0%)

- No withholding tax deduction on business income of small businesses

- Exemption from the requirement to deduct and account for tax on payments to vendors

- Simplified statement of accounts attested to by small business owner for tax returns in place of audited financial statements

- Introduction of the Office of Tax Ombud to protect taxp

- ayers against arbitrary tax assessments

- Tax disputes affecting businesses to be resolved within 14 days by the Tax Ombud

- Harmonisation of taxes and repeal of multiple levies

- Outlaw cash payment and physical roadblocks imposing burden on businesses

- Attractive tax regime to encourage formalisation of business and facilitate growth

Businesses and investments

-

- Reduction of corporate income tax rate from 30% to 25% and harmonisation of earmarked taxes at a reduced rate

-

- Unilateral tax credit for income earned abroad to avoid double taxation and input VAT credit on assets and services to reduce cost of production

- Introduction of economic development incentive for priority sectors

- Friendly tax regime for business restructuring and reorganisation to improve efficiency

- Clarity on 6-years statute of limitation and resolution of objections in favour of taxpayer if tax authority fails to respond within 90 days

- Option to pay taxes and levies on foreign currency denominated transactions in Naira

- Faster tax refunds within 90 days (30 days for VAT refunds) with the option of set-off against any tax liability of the taxpayer.

- Request for advance ruling by taxpaye

- r to be provided by tax authority within 21 days

- Expense incurred by a start-up within 6 years pre commencement of business to be tax deductible

- Restriction of interest deduction will only apply to related party loans in order to reduce cost of finance for businesses

High Income Earners and HNIs

-

- Tax exemption on personal effects not exceeding N5m, sale of dwelling house, and up to two private vehicles

- VAT exemption on purchase of real estate

-

- Clarity on taxation of benefit in kind and limit of taxable accommodation benefit to 20% of annual income

- Exemption of tax on sale of shares up to N150m and gains not exceeding N10m

- Progressive personal income tax rate up to 25% for HNIs

- Tax exemption on compensation for loss of employment not exceeding N50m

- Progressive VAT rate on items mostly

- consumed by high income earners to partly compensate for exemption on essential consumptions

- Tax exemption for income earned on bonds issued by states in addition to federal government bonds

- Reduction in corporate tax rate for businesses and tax break for hiring more people

- Exemption of tax on bonus shares for investors in Nigerian companies

Subnational government

- Federal government to cede 5% of VAT revenue to states

- Transfer of income from Electronic Money Transfer levy exclusively to states as part of stamp duties

- Repeal of the obsolete stamp duties law and re-enactment of a simplified law to enhance the revenue for states

- States to be entitled to the tax of Limited Liability Partnerships

- Tax exemption for state government bonds to be at par with federal government bonds

- More equitable model for VAT attribution and distribution

- Integrated tax administration to provide tax intelligence to states, strengthen capacity development and collaboration, and scope of Tax Appeal Tribunal to cover taxpayer disputes on state taxes

- Powers for AGF to deduct taxes un-remitted by a government or MDA and pay to the beneficiary government

- Framework to grant autonomy for states internal revenue service and enhanced Joint Revenue Board to promote collaborative fiscal federalism

- Legal framework for taxation of lottery and gaming, and introduction of withholding tax for the benefit of states.

Source: Taiwo Oyedele is the Chairman, Presidential Fiscal Policy and Tax Reforms Committee.